Upstream Support Center

We’re here to help!

GETTING STARTED

What is Upstream? What are Upstream’s market hours and trading days? What does it mean that Upstream is a MERJ Exchange Market? What is MERJ Exchange? How is MERJ regulated? Who can trade on Upstream? Who can buy Collectibles on Upstream? What devices can I trade on? Can a U.S.-based investor trade on Upstream? What opportunities can I participate in on Upstream? How much does it cost to use Upstream? What technology is powering Upstream? What is the vision behind Upstream?OPENING & FUNDING YOUR ACCOUNT

How do I open an Upstream account? When would you require my identification? What if i have trouble receiving my KYC code via SMS? How do I fund my Upstream account using PayPal? How do I fund my Upstream account using a debit or credit card? When I try to fund my account using a Debit or Credit Card, I’m asked to log in to PayPal. Why is this? How do I fund my Upstream Account using a Bank Wire Transfer? How are my U.S. Dollar funds kept safe? How do I use my Upstream wallet on Mainnet/Metamask? How do I fund my Upstream account with USDC cryptocurrency? How do I fund my Upstream account with USDT? How do I withdraw digital currency funds? How are my USDC funds kept safe? How long does it take for KYC identity verification to be verified? When will my funds be available to invest? How can I check the current balance of my Upstream funds? Is there a minimum funding requirement? How do I withdraw funds from my Upstream account? What are the fees to fund or withdraw funds from my account? Can I open a Joint or Corporate account?ACCOUNT MANAGEMENT & LOGIN

What is a Signing Key and why is it so important? How do I backup my Signing Key? How do I disable Two-Factor Authentication? What does the ‘Logout’ button do? What happens if I lose my phone, computer, or delete the app? What happens if I lost my Signing Key and forgot to back it up? How do I change or update my personal information? How do I change my bank information? How will you communicate with me about my account? Will I receive notices or statements? Will my account information remain confidential? How is the money in my Upstream account protected? How are the securities in my Upstream account protected? How do I enable biometric security? How do I close my Upstream account?TRADING & PORTFOLIO MANAGEMENT

Where do I go on the app to buy and sell securities from the market? What’s the Orderbook? How do I buy securities? How do I sell securities? How do I transfer shares to Upstream? How to move shares back to US markets What are the different order expiry options? How do I manage my security Portfolio? How do I sell securities from my Portfolio screen? How do I add a security to my Watchlist? How do I cancel an active securities order? How can I see the blockchain details for my orders? What are candlestick charts? Does Upstream offer margin trading? Does Upstream allow naked short selling? Does Upstream solicit trades? What are the fees associated with trading? What is a dividend? What is an ex-dividend and record date? What are the risks of investing?SHORT SELLING

What is Short Selling? What are the key features of Upstream's Short Selling service? As a stock lender, how do I create a loan? How does Upstream guarantee the return of my shares, without borrower-default risk? What is the Upstream Short-Liquidation Trigger? As a stock lender, when am I paid my lending fees? What are the maximum and minimum number of shares that I can lend? When do share loans expire? How long can I loan my shares for? As a stock lender, how do I cancel a loan offer? As a potential short seller, how do I see available loans? Does Upstream require margin before I can short a stock? Can I use margin cash that is set aside to cover a short stocks price rise for other purposes? As a short seller, how can I short a stock? As a short seller, how do I cover an open short position? What Upstream fees are charged during a short sale?OPTIONS TRADING

What is a Stock Warrant? What is Options Trading? What Options trading instruments does Upstream support? What Warrants trading instrument does Upstream support? What are the fees for trading Options on Upstream? What’s a Long Call (Option Holder)? What’s a Long Put (Option Holder)? What’s a Covered Call (Option Holder)? What’s a Short Put (Option Holder)? What are Options Strategies?MARKET POOLS

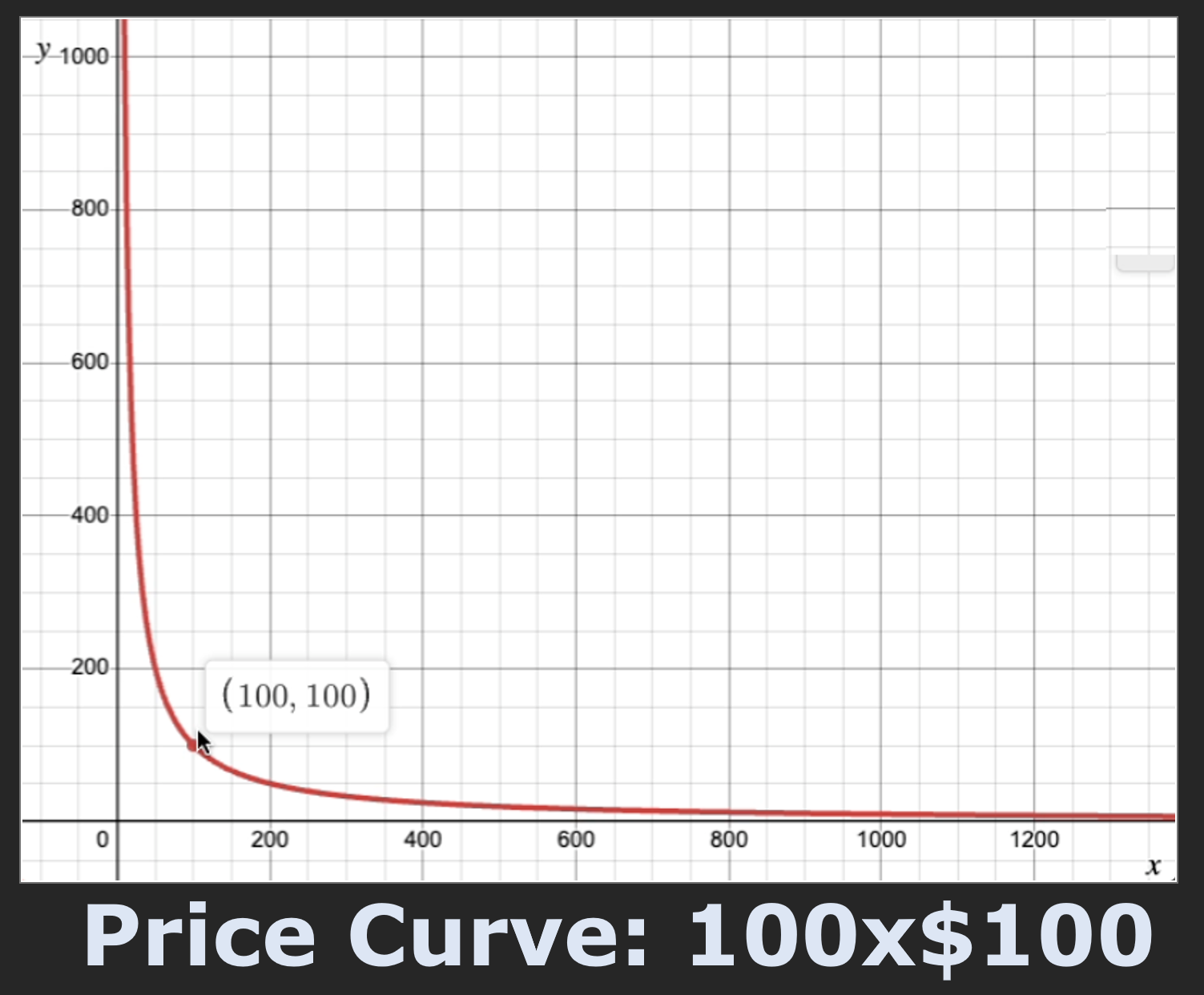

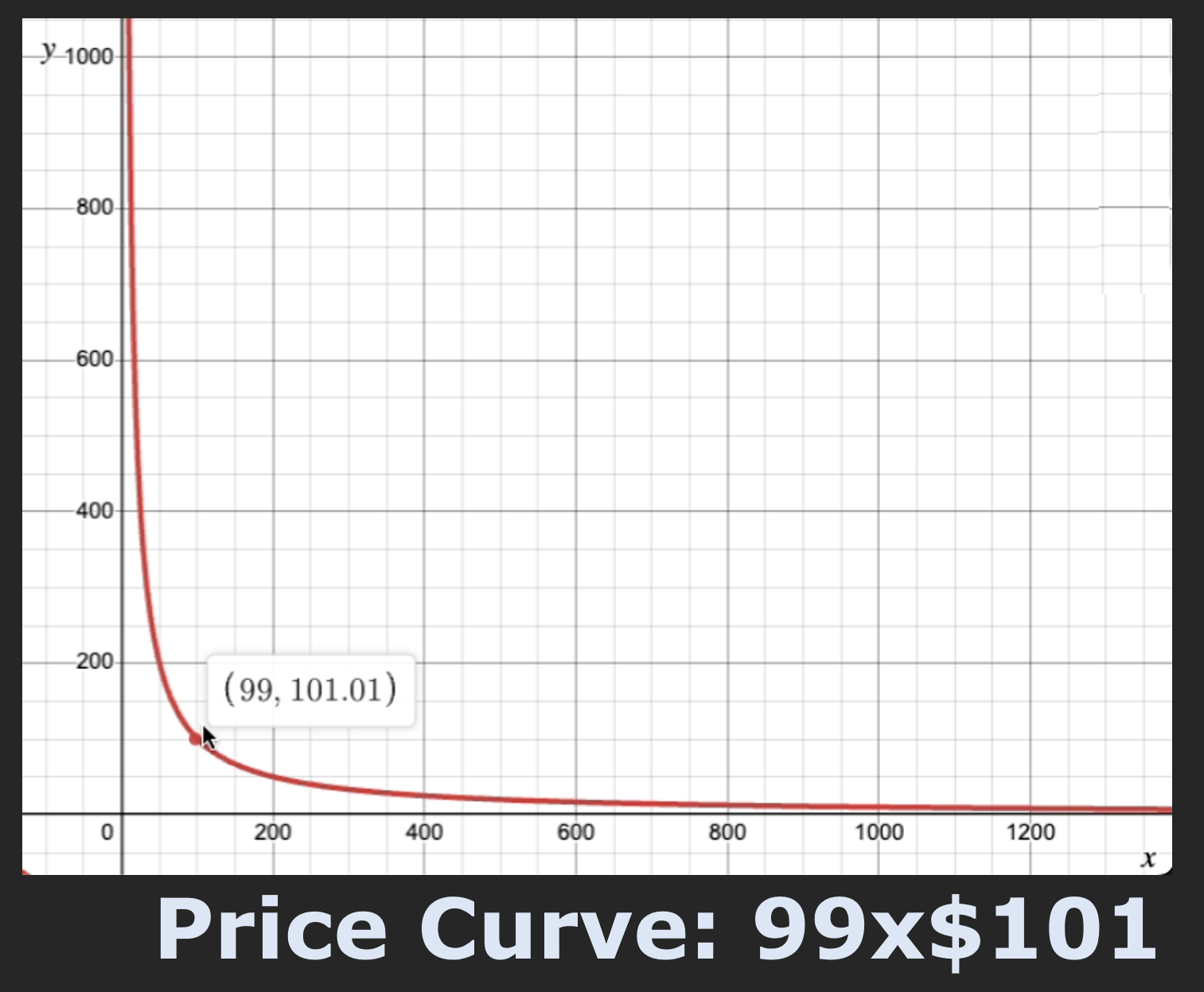

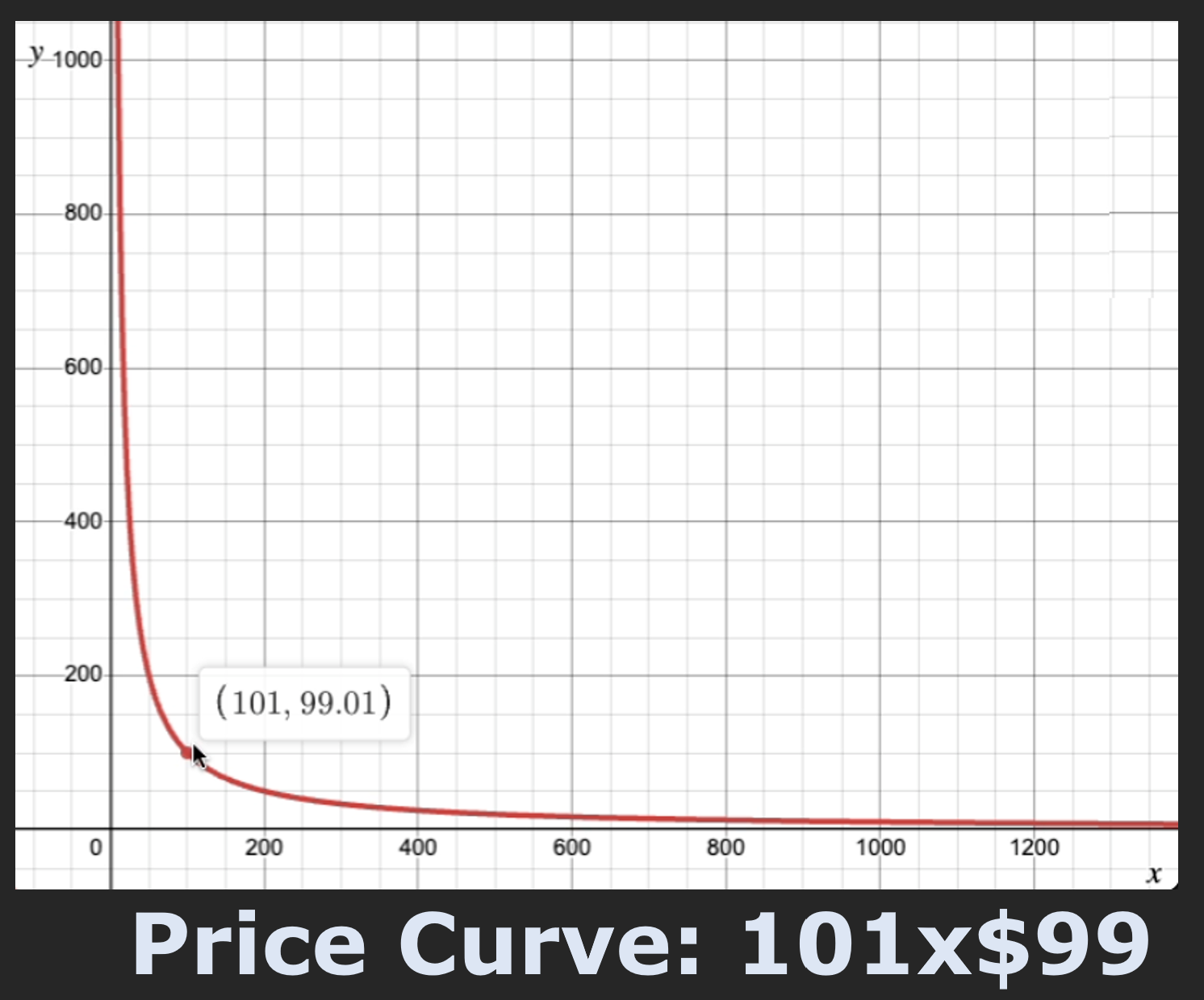

What are Market Pools? What happens to my shares when I deposit them into a Market Pool? What happens to my money when I deposit it into a Market Pool? Do Market Pools pay liquidity providers a fee? How can I withdraw my Market Pool earnings? How does Market Pool trading work? How do I evaluate the price my trade would get when a Market Pool is the counterparty? Can Upstreams' trading circuit breakers affect Market Pool trades? What happens if I try to buy all the shares inside a Market Pool? What happens if I try to bulk-sell my trades into a Market Pool? What is impermanent loss?COLLECTIBLES MARKET

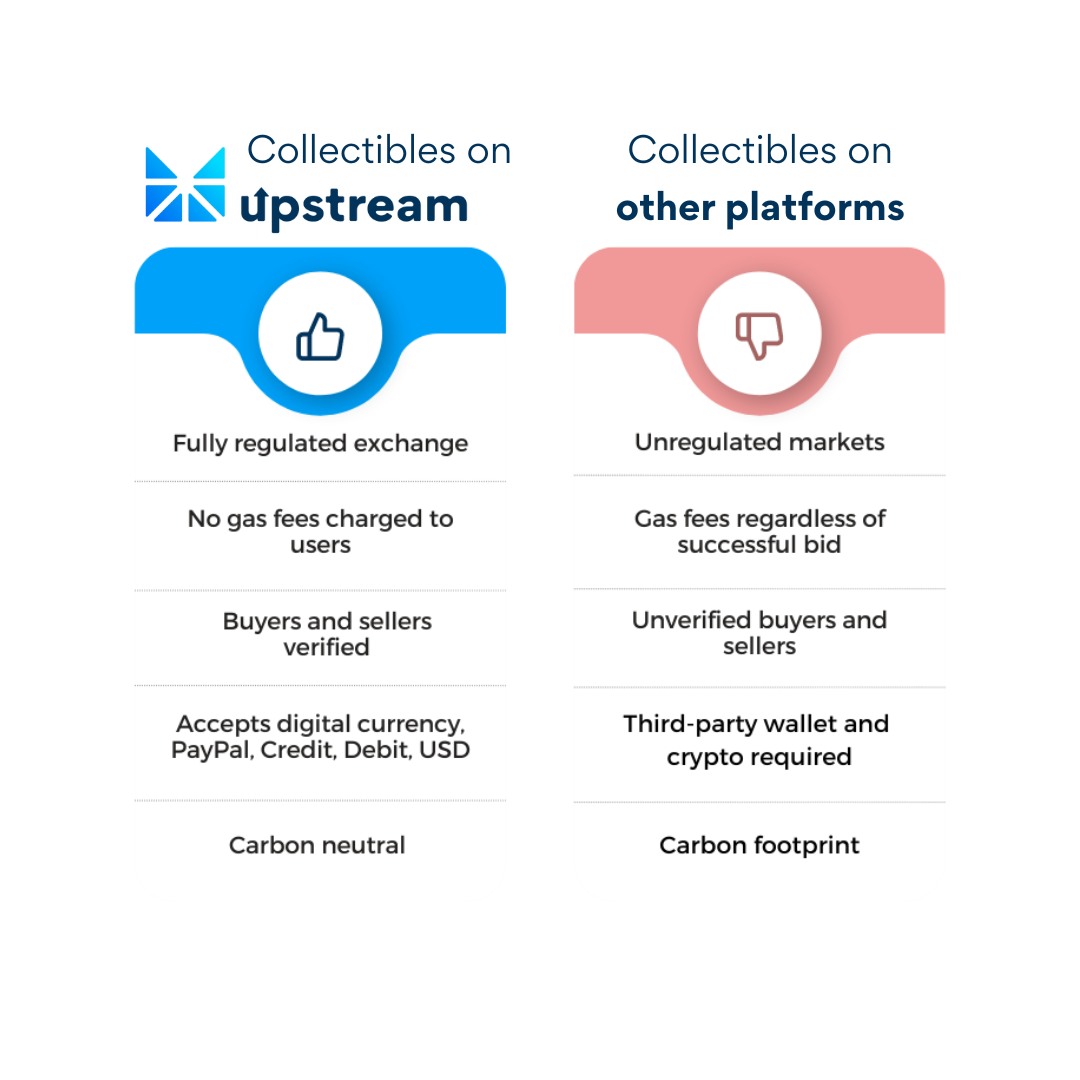

What is a Collectible? What is the Upstream Collectibles Marketplace? How do I Claim a Collectible? How can I purchase a Collectible? What’s a redeemable Collectible? How can I redeem a Collectibles? What are Collectible Transactions? What is a Collectibles Auction? How can I sell a Collectibles? What if I am the highest bidder when the Collectible Auction closes? Where can I create a Collectible? Can I track how my auction is doing? What happens if one or more people bid above my reserve price? What happens if nobody bids at or above my reserve price? Can I cancel an auction before the close? How do I place a bid? Where can I read the full Terms and Conditions for Collectible Auctions? What technical standard do Upstream Collectibles follow? How do I report objectionable Collectible media? How do I report copyright infringements of Collectible media offered for auction? When I own a Collectibles, what are my rights? How do I export my Collectible, and what is the fee for a Collectibles export? How can I “see” my exported Collectible in MetaMask? What might Upstream consider objectionable Collectible material? What are Upstream’s unique Collectible integrations? How do I book an intro call? What are the Collectibles on Upstream versus Collectibles on other platforms?GETTING LISTED ON UPSTREAM

How do I list my company on Upstream? How do I receive an application to list my company on Upstream? What are the benefits of listing my company on Upstream? Why should I make secondary trading a part of my growth strategy? What types of assets are traded on Upstream? What’s included in Upstream’s marketing package for listing? What is a digital coupon? How do I claim a digital coupon? How do I redeem a digital coupon?Dual Listings: How do I dual list on Upstream? What does Upstream offer dual listing issuers?

IPOs: What is an IPO? What makes Upstream IPOs unique? Why did I not get my full indication? When can I trade following the IPO? How long does it take for trades to settle on Upstream? How long does it take for IPO orders to settle on Upstream?

Spinoff Share Distribution: What is a spinoff share distribution? How do I participate in a spinoff share distribution? How do I request my spinoff share distribution? When can I trade my shares if they’re restricted?

GENERAL OFFER INFORMATION

What is a Prospectus? What are the major differences between common and preferred stock? What is a PIPE, private placement or secondary offering? What is Suitability? What is a Registration Statement? What is an Unaccredited investor?IN-APP ADVERTISING

What is Upstream IN-APP ADVERTISING service? Is my personal data shared with advertisers? How do I Opt-In to advertising services? How do I remove myself from the advertising services? How do I claim the rewards for viewing advertisements?FAQS

Are trades solicited on Upstream? What is the World Federation of Exchanges? Who is Upstream’s Cash Custodian? Is there any payment for order flow on Upstream? What is the "Pay Up" feature on Upstream?LEARN

Blog:Upstream Medium Podcast:

Upstream Up Close: https://www.youtube.com/ @upstreamexchange

Video Tutorials How To Transfer Shares Tutorial How to Claim and Redeem a Digital Coupon Tutorial How To Sell Securities How To Buy Securities How to Create an account on Upstream How to participate in a Collectible airdrop How to create an Collectible How to Perform KYC How to Withdraw Funds How to Share or Copy Your Wallet

GETTING STARTED

What is Upstream?

Upstream, part of MERJ Exchange, is global stock trading app. Powered by Horizon's ERC-20 smart-contract securities matching engine technology, and Horizon’s ERC-721 smart contract Collectible auction engine technology, Upstream enables investors to directly trade shares in dual listed companies, IPOs, celebrity ventures, and other unique asset classes directly from the blockchain-powered trading app. Investors can fund their Upstream trading account using a credit/debit card, PayPal, USDC stablecoin on Ethereum or traditional bank (fiat/legal tender) payments such as ACH in the U.S., or a wire transfer of funds in the U.S. and internationally.

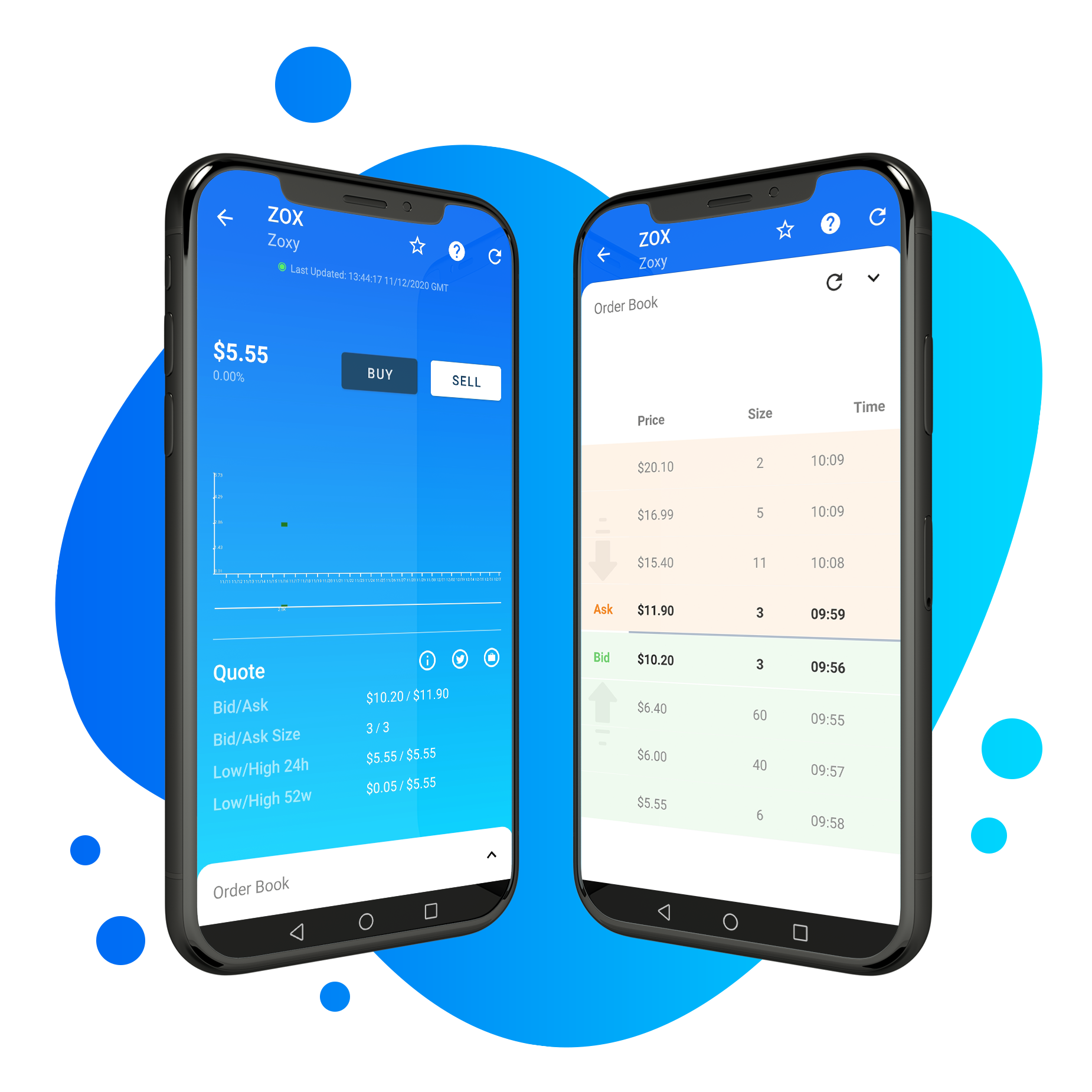

Upstream app layout

The Upstream app is made up of five separate tabs that can be selected by tapping the relevant icon at the bottom of the app screen:

- Home: Browse all dual listed, listed companies, IPO opportunities and Collectibles. See trending creators along with your account balance and public Upstream account/ wallet.

- Market: Buy and sell your securities, warrants, options and Collectibles. Tap the star icon to see your watchlist made up of any opportunities you’ve ‘starred’.

- Portfolio: Find your purchased or claimed assets, portfolio value, funding balance along with your investment performance/return.

- Investor: Fund your account; update personal details; claim, create, or redeem Collectibles; and export Collectibles to Ethereum.

- Profile Page: Tap the profile icon at top right of your screen. Find your account balance and your public Upstream account/wallet; complete light-touch KYC identity verification; view orders, withdraw funds to your bank account; manage custodial accounts (for users under 18); and other support. Don’t forget to back up your Signing Key by exporting it to a safe place.

All of these screens can be updated by dragging down on the screen, a “pull down to refresh” motion.

What are Upstream’s market hours and trading days?

Upstream is open for 20 hours per day, Monday through Sunday. Please visit https://merj.exchange/markets/market-hours for the latest on market hours and holidays.

What does it mean that Upstream is a MERJ Exchange Market?

Upstream is a MERJ Exchange market (MERJ). MERJ operates a fully regulated and licensed integrated securities exchange, clearing system and depository for digital and non-digital securities. MERJ is an affiliate member of the World Federation of Exchanges (WFE), a member of the African Stock Exchanges (ASEA), a member of the Committee of SADC Stock Exchange (CoSSE), a full member of the Association of National Numbering Agencies (ANNA) and a Qualifying Foreign Exchange for OTC Markets in the U.S. MERJ became one of the fastest growing exchanges in 2020 by disrupting the traditional stock exchange model.

What is MERJ Exchange?

MERJ Exchange is an innovative end-to-end, multi-market global financial exchange for equities, debt and derivatives. MERJ has expanded its capabilities by providing markets and services for security tokens and digital assets. Visit https://merj.exchange/.

How is MERJ regulated?

MERJ is overseen and regulated by the Seychelles Financial Services Authority ("FSA") which is the securities and other non-banking financial services regulator in the Republic of Seychelles. The Seychelles FSA is also the primary regulator for anti-money laundering compliance and works closely with the FIU to implement and ensure adherence to OECD Financial Action Task Force (FATF) recommendations.

Who can trade on Upstream?

Upstream, a MERJ Exchange Market, is a global exchange for traders of all ages. To create an Upstream account, you’ll need to meet the following basic requirements:

Requirements for traders over 18 years old

- 18 years or older

- Mobile/cell phone, capable of receiving SMS**

- Email address

U.S. persons may not deposit, buy, or sell securities on Upstream. However, U.S. persons may create, buy, auction or bid-for Collectibles on Upstream. U.S. person additional requirement.

- National, or state, Photo ID

U.S. person additional requirement

- Social Security Number

Canadian residents may not buy securities on Upstream

Requirements for traders under 18 years old

- 17 years or younger may participate on Upstream using a custodial account

- A parent or guardian must fulfill the investor requirements for users over 18 to create an account and complete KYC. Once KYC is verified, a parent or guardian may tap KYC again to create a KYC code for the dependent account.

- The trader may then enter this KYC code from the parent or guardian by opening the Upstream app on their device, tapping the profile icon, KYC, then tapping “no” when asked if 18 or over, then entering the provided KYC code where prompted.

Funding requirements

- If funding with a national currency, or a valid debit or credit card.

- If funding with USDC, an Ethereum mainnet wallet/address.

*Trading not available for citizens of countries restricted by the Office of Foreign Assets Control (OFAC), Financial Action Task Force (FATF) identified high-risk and non-cooperative jurisdictions, and other high-risk jurisdictions, designated at the sole discretion of Upstream.

** Trouble receiving an SMS in your region? Go here for alternate instructions.

Who can buy Collectibles on Upstream?

Everyone can purchase or claim Collectibles.

What devices can I trade on?

Trading and account openings are only available through our Apple (iOS) and Google (Android) smartphone apps, as well as our Apple Mac OS desktop app. Account access should be secured using the biometric security feature and/or the two-factor authentication feature of the Upstream apps on your smart devices.

Can a U.S.-based investor trade on Upstream?

U.S. persons may not deposit, buy, or sell securities on Upstream. However, U.S. persons may create, buy, auction or bid-for Collectibles on Upstream.

What opportunities can I participate in on Upstream?

Deposit, buy and sell stocks and collectibles from U.S. and international companies on one global trading app.

How much does it cost to use Upstream?

Upstream sign-up is free. There are no associated membership fees, no minimum dollar amount to maintain an account and no order-placement fees or Collectible bidding fees.

There is a 1% fee charged when your securities buy or sell order executes on the Upstream secondary market.

Upstream does not charge its 1% fee to Collectible buyers, it charges 2% to successful Collectible sellers.

How long does it take for IPO orders to settle on Upstream?

IPO orders on the Upstream primary market settle immediately upon IPO close. A buyer must have sufficient funds in their account to place an IPO buy order. This ensures that the issuer is paid, in full, immediately upon IPO close. Upstream does not permit U.S. persons to participate in IPOs.

What technology is powering Upstream?

Upstream is operated as a regulated stock exchange by Horizon Globex GmbH (Horizon) and MERJ Exchange. Upstream is powered by Horizon’s ERC-20 smart contract securities ecosystem, and Horizon’s ERC-721 smart contract Collectible ecosystem, running on an Ethereum layer-2 optimistic-rollup proof-of-authority blockchain, Ráneum. 7 years in the making, Horizon’s tech. stack offers a one-stop shop from securities issuance through to secondary trading and settlement as well as Collectible minting, auction and settlement. The Horizon trading technology suite covers initial securities and Collectible issuances, onboarding KYC/AML, cap. table management, dividend payment, regulatory compliance, listing for of securities and Collectibles for secondary trading on Upstream. Learn more at https: //www.horizonfintex.com/ .

What is the vision behind Upstream?

We aim to unlock liquidity for investors of all levels on our investor-driven, app-based market. On the surface, Upstream offers global investors a real-time, secure, and intuitive trading app. Under the hood, Upstream introduces what we believe to be the future of securities and Collectible trading featuring some of the highest levels of transparency, accessibility, and investor protections enforced using Ethereum smart-contract technology.

OPENING & FUNDING YOUR ACCOUNT

How do I open an Upstream account?

Signing up for an Upstream account is easy. Simply download the App from Google Play, Apple Store and Mac App Store and follow the instructions on your screen. Begin browsing available opportunities immediately.

General

- Download Upstream and tap Sign Up. This will create your Upstream account/ wallet and ‘signing key’.

- Browse securities and Collectible opportunities immediately.

- We recommend completing KYC identity verification at your convenience by tapping the profile icon, then KYC. This way in the event of losing your phone or details, we can “restore” your assets.

Dual listings and IPOs

- DOWNLOAD UPSTREAM and tap Sign Up. This will create your Upstream account/ wallet and ‘signing key’.

- COMPLETE KYC. To complete KYC identity verification tap the profile icon in the top right of the navigation, then KYC. Be sure to have a valid form of ID handy.

- FUND YOUR ACCOUNT. For Credit, Debit, or PayPal; Tap Investor, Fund my Account, Tap your desired funding method.

- PURCHASE SHARES. Navigate to Market and find the securities you’d like to purchase, Tap Buy, enter the number of shares you’d like to purchase and tap Buy. Find your active and pending orders in the Orders tab. For IPOs, you may cancel your order up to 48 hours prior to the offering close date. After the offering closes, navigate to the Portfolio to find your shares.

Collectibles

To claim a free Collectible- DOWNLOAD UPSTREAM and tap sign up.

- CLAIM COLLECTIBLE. Open Upstream, Tap investor, Collectible, claim, enter the claim code once revealed.

- HOLD OR TRADE COLLECTIBLE. You will receive a push notification and find your Collectible in your Upstream portfolio.

- DOWNLOAD UPSTREAM and tap sign up.

- FUND YOUR ACCOUNT. To fund using a debit/credit card, or PayPal, tap investor, fund my account, then tap your desired funding method.

- PURCHASE COLLECTIBLE. Tap market, tap Collectibles in top navigation bar, tap desired Collectible, enter bid amount, then tap Buy Now.

- HOLD OR TRADE COLLECTIBLE. You will receive a push notification and find your Collectible in your Upstream portfolio.

Custodial account for minors under 18 years of age

- Parent or guardian downloads Upstream and taps Sign Up.

- Parent or guardian completes KYC identity verification by tapping the profile icon, then tapping KYC.

- Parent or guardian can fund their account once KYC is approved. Custodial accounts for U.S. persons may not trade securities on Upstream.

- Parent of guardian can then tap the profile icon, then tap KYC to create a code to provide to the minor.

- Using Upstream’s Account-Management feature, parents and guardians can transfer funds, Collectibles and securities to the minor's Upstream account/wallet.

- Minor downloads Upstream and signs up.

- Minor tap KYC and enters the KYC code provided by the parent or guardian into their Upstream app which tethers them to their parent or guardian’s verified account.

Watch tutorial video on how to create an account

How are my U.S. Dollar funds kept safe?

U.S. Dollar withdrawals from a trader's Upstream app will only ever be sent to the same bank account from where the investor originally funded from.

When would you require my identification?

Once your Upstream account balance reaches $500 or more, you will be prompted to complete our light-touch KYC process to continue trading, which we’ve made as fast and frictionless as possible. Complete a few pieces of personal information, snap a photo of your ID, then we’ll verify your data. Once approved, you can continue to fund, you can withdraw cash, and, of course, continue to trade Collectibles and all available quoted securities.

What to have handy:

- Photo ID such as a driver’s license or passport

- Social Security Number (U.S. only)

- Personal bank account info., or Ethereum address

Upstream is a fully regulated marketplace. Verifying that you are who you say you are is legally required in order for you to trade safely and securely. This is to prevent money laundering, illicit activity, and bad actors from entering our Upstream community.

We ensure all your personally identifiable information is secure and in accordance with the most stringent global data protection rules. In fact, all data submissions awaiting review are kept in memory in an auto expiring cache and identity verification is never outsourced to a third party.

What if i have trouble receiving my KYC code via SMS?

Depending on your location or coverage, you may experience trouble receiving your verification SMS TAN during the KYC process. To assist you in these circumstances, we provide an alternate method to receive your KYC code. Visit https://kyc.upstream.exchange/whatsmycode to retrieve your code.

How do I fund my Upstream account using Paypal?

- Login to your Upstream account

- Tap Investor

- Tap Fund My Account

- Tap Fund With PayPal

- Tap the amount you'd like to fund

- Confirm the amount you'd like to fund

- Login to your PayPal acccount

- Tap Pay Now

*Note you don't have to have a PayPal account to fund your account using a credit or debit card.

When funding your account with PayPal, a fee of 3.49% + 49c is applied to deposits from US customers. A fee of 4.99% + 49c is applied to International Customers.

Watch tutorial on how to fund using PayPal

How do I fund my Upstream account using a Debit or Credit Card?

- Login to your Upstream account

- Tap Investor

- Tap Fund My Account

- Tap Fund With Credit Card

- Tap the amount you'd like to fund

- Confirm the amount you'd like to fund

- Tap the button under login that says "Pay with Debit or Credit Card"

- Tap Pay Now

*Note you don't have to have a PayPal account to fund your account using a credit or debit card.

When funding your account with PayPal, a fee of 3.49% + 49c is applied to deposits from US customers. A fee of 4.99% + 49c is applied to International Customers.

Watch tutorial video on how to fund using debit or credit

When I try to fund my account using a Debit or Credit Card, I’m asked to log in to PayPal. Why is this?

On rare occasions, users may find that they are asked to log in to or create a PayPal account, even when they tap the Fund With Credit Card link in their app. Our credit card payment processor, PayPal, will only show this option based on your device; typically the device’s location, if the email entered has previously been linked to a PayPal account or local cached internet files (If you have frequently used PayPal guest checkout services on your device). If you only see the option to use a PayPal account, try clearing your device’s default web browser’s internet cache and try again. For details on how to do this, please consult the help files on your default web browser. If the issue persists, you will need to create a PayPal login and link your credit card to the account, or fund using an alternative method such as USD wire transfer.

How do I fund my Upstream Account using a Bank Wire Transfer?

To fund a trading account on Upstream using bank payments a trader will need to first go through our streamlined Know Your Customer ‘KYC’ identity verification process.

To complete KYC, tap the profile icon in the navigation bar, then tap KYC. Be sure to have a valid form of ID handy and complete the few questions as prompted. During KYC, select 'Bank' as your 'Payment From' preference. After KYC is approved, traders may initiate a wire or a funds-transfer from any bank or financial institution to the following account:

*The traders 40-character Ethereum wallet address is shown on the top right hand corner of the Upstream app’s home screen and begins with 0x.

After an account is funded the trader will receive an app push notification that the Upstream account is funded, and you may begin transacting.

Every Upstream trader that funds their account receives a new, U.S. Dollar bank account at Upstream’s U.S. banking partner, Absa Bank (Seychelles) Limited. Citizens of any country in the world, excluding sanctioned territories*, may fund their Upstream account with currency from their country which, when not originating in U.S. Dollars, will be exchanged for U.S. Dollars at the prevailing currency exchange rate between the two banks.

Note, in-line with Upstream’s anti-money laundering compliance policy, Upstream does not permit third-party bank transfers. In other words, the sending bank account must have the same name as the name provided by the trader during Upstream’s KYC process.

Bank account information, and currency transfer instructions, will also be emailed to the trader after Upstream approves a traders KYC information.

How are my U.S. Dollar funds kept safe?

All Upstream accounts are individually insured and are bankruptcy protected. See here for details. For additional investor security, U.S. Dollar withdrawals from a trader's Upstream app will only ever be sent to the same bank account from where the investor originally funded from.

How do I use my Upstream wallet on Mainnet/Metamask

-

Export Upstream Wallet

In order to use an Upstream address on Ethereum mainnet, the Upstream user must export their Upstream wallet using the Upstream app function 'Manage Signing Key' -> 'Export Signing Key'. The Upstream key/wallet is exported as a password-encrypted (JSON) text file, which can be imported into Metamask (amongst other Ethereum wallet providers). -

Import Upstream Wallet to Metamask

- Open Metamask

- Tap the icon on the top right corner

- Tap 'Import Account'

- Select type as 'JSON File'

- Tap 'Choose File'

- Select the file previously exported from Upstream

- Enter your Upstream wallet password

- Tap 'Import'

Your Upstream wallet address on Metamask may now sign Ethereum mainnet transactions.

How do I fund my Upstream account with USDC cryptocurrency?

Upstream traders can transfer USDC cryptocurrency into Upstream via the Upstream Bridge smart contract on Ethereum mainnet usdc.upstreambridge.eth.

The Upstream Bridge is a Multisig smart contract that is monitored for USDC deposits by the Upstream bridge-service application. For each eligible Ethereum mainnet USDC deposit received, a 1-to-1 mint of Upstream’s Ethereum Layer-2 US Dollar stablecoin is performed for the wallet address of the sender, thereby locking Ethereum Layer-1 USDC’s while making the same amount of money available for the sender on Upstream, this is commonly called a ‘bridge’.

It is imperative that the Ethereum mainnet senders address is the same as the Upstream app user address. To find the Upstream address, navigate to your profile page inside the app and the address is shown as 0x followed by a unique 40 character alphanumeric string per user.

Funding with USDC

An Upstream user may have a personal USDC wallet on Ethereum mainnet in a hardware wallet (such as Ledger), a software wallet (such as Metamask), or at an exchange (such as Coinbase). To send funds from their personal wallet on the Ethereum mainnet, the user must first transfer USDC from their mainnet personal wallet to the Upstream wallet address that they previously imported to Metamask.

Once the USDC is in the Upstream wallet address on Ethereum mainnet, the user can transfer USDC to the usdc.upstreambridge.eth address using Metamask.

The Upstream bridge-service automatically recognizes user deposits coming from known Upstream wallet addresses and then mints the corresponding amount in Upstream US Dollar stablecoins in the users Upstream app.

In summary, to fund Upstream using USDC:

- Export Upstream app wallet & import to Metamask

- Transfer USDC to imported wallet address

- Transfer imported wallet USDC to usdc.upstreambridge.eth

Why Can’t I Transfer USDC Directly from my Personal Wallet?

Upstream does not mint Upstream US Dollar stablecoins from USDC deposits on Ethereum mainnet from addresses that do match existing Upstream app wallet addresses. Invalid deposits cannot be rejected by Upstream due to the nature of blockchain transfer functions, but they will be ignored and such funds may be lost forever

How do I fund my Upstream account with USDT?

Upstream traders can transfer USDT (Tether)) into Upstream via the Upstream Bridge smart contract on Ethereum mainnet usdt.upstreambridge.eth.

The Upstream Bridge is a Multisig smart contract that is monitored for USDT deposits by the Upstream bridge-service application. The Upstream bridge-service automatically recognizes user deposits coming from known Upstream wallet addresses and then mints the corresponding amount in Upstream US Dollar stablecoins in the users Upstream app.

In summary, to fund Upstream using USDC:

It is imperative that the Ethereum mainnet senders address is the same as the Upstream app user address. To find the Upstream address, navigate to your profile page inside the app and the address is shown as 0x followed by a unique 40 character alphanumeric string per user.

- Export Your Upstream Wallet Address: Begin by exporting your Upstream wallet address. This is the address where you will receive your USDT.

- Import to Metamask: Next, import your Upstream wallet address into your Metamask wallet. Metamask is a popular cryptocurrency wallet that allows you to manage your digital assets securely.

- Transfer USDT: Transfer USDT from your personal wallet to the imported wallet address in Metamask.

- Final Transfer: Finally, transfer the USDT from the imported wallet address to usdt.upstreambridge.eth.

WHY CAN’T I TRANSFER USDC or USDT DIRECTLY FROM MY PERSONAL WALLET?

Upstream does not mint Upstream US Dollar stablecoins from USDC deposits on Ethereum mainnet from addresses that do match existing Upstream app wallet addresses. Invalid deposits cannot be rejected by Upstream due to the nature of blockchain transfer functions, but they will be ignored and such funds may be lost forever

HOW DO I WITHDRAW DIGITAL CURRENCY FUNDS?

It must be noted that if an Upstream user ever funded their account with US Dollar fiat (bank transfer, debit card, or credit card), then Upstream app withdrawals will automatically be in fiat, irrespective of whether the user partially funded with USDC in the past. Therefore, only if a user funded exclusively in USDC or USDT will this user be considered eligible to withdraw in USDC. While you cannot withdraw via USDT, you can easily withdraw from Upstream to USD.

To withdraw funds on the Upstream app:

- Tap the profile icon

- Tap ‘Manage Account’

- Tap ‘Withdraw’

- Enter the amount

- Tap ‘Confirm’

- The Upstream app will now sign the transaction and submit it

For eligible Upstream USDC or USDT- funded users, this action causes the Upstream bridge-service wallet to initiate the Ethereum mainnet withdrawal process inside the usdc.upstreambridge.eth Multisig smart contract.

For security purposes, this smart contract requires another two out of a possible four Upstream back-office personnel to confirm the withdrawal. They do this by signing an Ethereum transaction from a registered wallet.

Pending withdrawals can be found at https://upstream.exchange/bridge/index.html?symbol=USDC.

Upon multi-signature by the two Upstream personnel, the users USDC funds are available for transfer to the Ethereum mainnet wallet address that equals the Upstream app wallet address that initiated the withdrawal.

The withdrawing user must then connect their wallet to the Upstream USDC-withdrawal website by tapping the ‘Connect Wallet’ button, and tapping the ‘Withdraw’ button to complete their withdrawal. The user will be prompted by Metamask to pay the Ethereum gas fees associated with the previous three Upstream staffs’ Multisig actions, and taps ‘confirm’ to have the USDC transferred from the Upstream smart contract to their Ethereum mainnet wallet address. The USDC can now be transferred back to the user's personal wallet.

Note, Upstream does not charge a USDC withdrawal fee. The exact number of US Dollars withdrawn from Upstream will be transferred to the user on Ethereum mainnet as USDC.

In summary, to withdraw USDC from Upstream:

- Export Upstream app wallet & import to Metamask

- Tap ‘Withdraw’ in Upstream app

- Connect imported wallet to https://upstream.exchange/bridge/index.html?symbol=USDC

- Tap ‘Withdraw USDC’

How are my USDC funds kept safe?

USDC funds held inside the usdc.upstreambridge.eth smart contract may only be withdrawn after three out of five Upstream Multisig wallets confirm the legitimacy of the withdrawal. And, only the Upstream bridge-service wallet address may initiate the withdrawal process on Ethereum mainnet.

The Upstream Multisig smart contract source code is public, is audited, and may be reviewed at any time by the Upstream community.

Rebalance to Cover Risk

To reduce the likelihood of the smart contract becoming a high-value target for hackers, there is a maximum amount of USDC that Upstream will allow to be held inside the bridge at any one time, currently 10,000. Therefore, once the threshold is exceeded the Upstream back-office will initiate a USDC withdrawal to Upstream’s mainnet company wallet, where USDC will be sold on a cryptocurrency exchange for US Dollar fiat. The fiat sales proceeds will be deposited in Upstream’s U.S. bank account.

Rebalance to Cover Withdrawals

In the event that the balance of USDC available for withdrawal is too low to cover pending withdrawal requests, currently 7,500, then Upstream will sell US Dollar fiat from its bank account for USDC, and transfer the USDC proceeds back to the usdc.upstreambridge.eth Multisig smart contract.

How long does it take for KYC identity verification to be verified?

Assuming you have provided the appropriate KYC information, approvals can be as fast as 15 minutes and, depending on date, time and queue, it could take up to 48 hours (about 2 days), Monday to Friday. If additional information is required, or if we have many submissions awaiting approval, it could take up to 2 weeks.

Security Note: Depositing funds to your Upstream bank account without a prior deposit-intent may delay your funds’ arrival in your Upstream trading account.

Deposits will only be accepted from the account number that you supplied during the Upstream app onboarding process. This is for your protection.

When will my funds be available to invest?

PayPal | Credit | Debit cards: Instantly

USDC typically within 15 minutes

How can I check the current balance of my Upstream funds?

You can see the balance of your funds in the Portfolio screen on Upstream. Note, there are two numbers shown; one is the actual Balance of funds and the other is the Available Balance of funds you have available for trading. The available balance will be lower than the actual balance if you have already placed one or more securities buy orders or Collectible bids. The total value of your buy orders (share price * order size), and maximum Collectible bid, is blocked on your Upstream trading account until your order is executed, is cancelled by you, or expires at the Upstream exchange.

Is there a minimum funding requirement?

There are no minimum funding requirements, however you may not trade in an amount greater than your account is funded.

How do I withdraw funds from my Upstream account?

Login to your account

Tap the profile icon

Tap Manage Account

Tap Withdraw

Enter amount you intend to withdraw from your Upstream account

Tap Confirm

Your withdrawal request will be processed by PayPal if your withdrawal amount does not exceed your original PayPal/Credit Card/Debit Card deposit amount. For withdrawals above this amount, the withdrawal will be processed by the Upstream banking partner using the Upstream API. However, certain AML and suspicious transaction checks may be made by Upstream or our custodians which may delay your withdrawal and we may request further information from you by email or by calling your cellular phone.

In the U.S., ACH transfers typically take 1 day, and international bank transfers typically take up to 3 days to arrive at your personal bank account.

Security Note: Withdrawals will only be sent to the bank account number that you supplied during the Upstream app onboarding process. This is for your protection.

What are the fees to fund or withdraw funds from my account?

There are no fees to maintain your account however there are fees associated with individual actions including the following (all fees will be deducted from your cash balances):

Outgoing/Withdrawal Wire Transfer Fee from your Upstream account to your local bank account:

ACH Free

International Wires $30.00

PayPal 2.99% (U.S. Only)

PayPal 2.99% + local currency fee

When funding your account with PayPal, a fee of 3.49% + 49c is applied to deposits from US customers. A fee of 4.99% + 49c is applied to International Customers.

USDC Fees

You only pay the Ethereum transaction fee (gas) to transfer USDC into Upstream and out of Upstream.

Securities Trading Fee: 1% trade fee charged should you buy or sell shares in the open market.

Collectible Trading Fee: 0% to buy Collectibles and 2% to sell Collectibles.

Collectible Auction Fee: $1 fee to list a Collectible for auction.

Can I open a Joint or Corporate account?

Yes, to open a corporate account during KYC identity verification please select 'Bank' as your deposit from method and enter the name of the company in the field provided. To complete KYC open the Upstream app, tap the profile icon in the top right, then KYC. On the Payment Details screen where it says Deposit From, hold and scroll to change the default from 'Card' to 'Bank'. Form fields will appear for your company name and company bank details. U.S. domiciled companies or non-U.S. companies whose ultimate beneficial owner(s) is a U.S. person may not trade securities on Upstream.

ACCOUNT MANAGEMENT & LOGIN

What is a Signing Key and why is it so important?

A Signing Key is a way of storing a password protected file that contains your blockchain public and private keys, together this makes a key pair. Upstream will never know your local private key. A great way to think about your Signing Key is like a Pin Code to your ATM card. When you join Upstream, you are entering into a non-custodial environment. This means that you control your assets directly on your device. To make things easy, we make this Signing Key unlockable using your biometrics and this check is enacted every time you make a blockchain transaction, such as a buy, sell, bid, auction, or funds withdrawal on Upstream.

It's critical that you export a copy of your Signing Key to a safe place. This way if you lose your device or forget your password, you’ll be able to recover your securities and Collectibles using your private key.

How do I backup my Signing Key?

When signing up on the Upstream app, you will be required to back-up your Signing Key to the cloud as part of the account creation process. On Android OS smartphones, you’ll be prompted to save to your phone’s Google Drive cloud account, in the root folder (Example: keystore_0x9a2ab7f1b6d00d6ae79e29d8f8d0f33e7608b508.txt). For iOS, we'll automatically back this up to an iCloud App Container, which cannot be accessed from outside the app.

You can also make a back-up of your app’s Signing Key at any time by going to the tapping the profile icon tapping “Manage Signing Key” and tapping the “Export Signing Key” button. You will be prompted for your biometric verification or the Keystore password. Upon successful verification you will be prompted to select a destination for your Keystore (such as Mail, Notes etc.). Note, the Keystore, when exported, remains password protected and is useless to anyone that does not know your password.

For IOS users who are receiving an iCloud backup message:

If you’re receiving a message about iCloud Backup on your iOS device, this could mean that you’re not signed into iCloud or that your iCloud drive is turned off. Please go to your iOS settings, tap your iCloud profile, sign into iCloud, tap iCloud, tap iCloud drive and turn it on.

How do I disable Two-Factor Authentication?

You can disable two-factor authentication by clicking the setting icon then tapping “Unlink Authenticator”. Disabling two-factor authentication is not recommended as it reduces the overall security of your Upstream app on your device.

What does the “Logout” button do?

On the profile screen you will see a “Logout” button. Tapping Logout will terminate your session at the server, and you will be required to reauthenticate (using two-factor authentication, when enabled) again. It is a very secure way to disconnect your app if you will not be using it for a few days.

What happens if I lose my phone, computer, or delete the app?

As long as you have your Signing Key safely backed-up, it’s easy to get back to your account.

- Download the app

- Tap Login

- Tap Import Keystore

- Select from the file system

- Enter the Keystore password

- Welcome back to Upstream

What happens if I lost my Signing Key or forgot to back it up?

Contact servicedesk@upstream.exchange

How do I change or update my personal information?

Tap the “Investor” tab at the bottom of the Upstream app, then tap “Update Personal Information” tile and select the information that you wish to change and “Notarize” the information using your Signing Key. If you are having difficulty or have any questions on this, please contact servicedesk@upstream.exchange.

How do I change my bank information?

- Tap Investor

- Tap Update Personal

- Enter new details in

- Tap notarise

How will you communicate with me about my account?

Every Upstream deposit of funds is confirmed to the user by email. A push notification is sent to the Upstream app and will appear in the Message Center.

Every Upstream buy or sell order is notified to the user by a push notification to the Upstream app and in your “Message Center”.

Will I receive notices or statements?

Upstream users that have passed KYC may request monthly account statements by contacting us by e‐mail at servicedesk@upstream.exchange.

Will my account information remain confidential?

We believe that your wealth is an extremely private matter and your identity and financial records are kept strictly confidential. No mailing lists are sold, nor is any client information shared with outside firms unless legally mandated or directed by you. For more information, please see our privacy policy.

How is the money in my Upstream account protected?

All Upstream accounts are individually insured and are bankruptcy protected. See here for details.

Upstream USDC funds, U.S. and non-U.S., may be sold Upstream for US Dollars (fiat) at Upstream’s sole discretion.

How are the securities in my Upstream account protected?

Upstream securities are issued by registered companies with verified management teams that have their share register managed by a designated share registrar in conjunction with Upstream. When using Upstream, all shareholder names and balances are known to the issuing CEO and their share registrar. In the event that your device is lost or stolen, and you are unable to recover your Private Key from your Signing Key backup, then Upstream will assist you in replacing your lost (digital) shares by liaising with the issuer, their registrar and yourself to cancel the lost shares, and issue new shares in their place to your new, re-verified, Upstream account. You can contact us at servicedesk@upstream.exchange to replace lost shares.

The market value of securities positions in Upstream is not insured and is subject to market fluctuations and risk. U.S. person may not hold securities on Upstream.

How do I enable biometric security?

The Upstream app allows you to enable biometric verification for trades and withdrawals by tapping the profile icon, tapping “Settings” and sliding the “Use Biometrics for Keystore”.

How do I close my Upstream account?

Please contact us at servicedesk@upstream.exchange to close your Upstream account.

TRADING & PORTFOLIO MANAGEMENT

Where do I go on the app to buy and sell securities from the market?

Once you navigate to the market, you have the option to view all available securities. Tap on any of the securities to see its current share price, share history, buy and sell your shares, and view the Orderbook. U.S. persons may not trade securities on Upstream.

What’s the Orderbook?

The Orderbook shows best bids and offers for a given security in real-time. Since Upstream is based on a public blockchain, every Upstream trader can see the complete orderbook depth. There are no hidden orders or iceberg orders allowed on Upstream. All Upstream orders must be signed using a Private Key on the app and no automated, high frequency or algorithmic trading is permitted. So, on Upstream, every trader has fair and equal access to the market data. And Upstream does not sell or otherwise make its real-time trading-data available to third parties, APIs or algorithmic trading services.

How do I buy securities?

- Navigate to the Market

- Tap on the security you’d like to buy

- Tap Buy; U.S. persons may not buy securities on Upstream.

- Set the Limit Price (i) (The Limit Price for a buy, aka a bid, is the highest share price you’re willing to pay for the security) You’re guaranteed to pay the price you set or less for your securities. Please note that the default Limit Price is automatically set to the current best price available on the market. The minimum price is $0.01.

- Select your Order Size (i) (The Order Size represents how many shares you’d like to purchase for the price you set per share) by typing in the number of shares you’d like to buy for the price you’ve set or sliding the scale to your desired amount of shares you’d like to purchase.

- You must have sufficient funds to complete the share purchase as entered plus the 1% fee. Note, while your order is awaiting execution, the funds required for this transaction will not be available to you for other buy orders. You must have sufficient funds available to fulfil all of your open Buy orders.

- Hold and drag the Select Expiry button to select how long you want your selected offer to buy the securities to be available on the market.

- Tap the Buy button and verify your identity using biometrics and your order will be signed by the Upstream app and submitted to the blockchain orderbook.

- If your order is filled or partially filled based on the parameters you’ve set, you’ll be notified via the app. The new shares will appear in the Portfolio section of the Upstream app and your available funds will be reduced by the trade value (avg. share price * order size) plus 1%.

- You can see all your previous orders or active orders waiting to be filled by navigating to the Orders tab in the app.

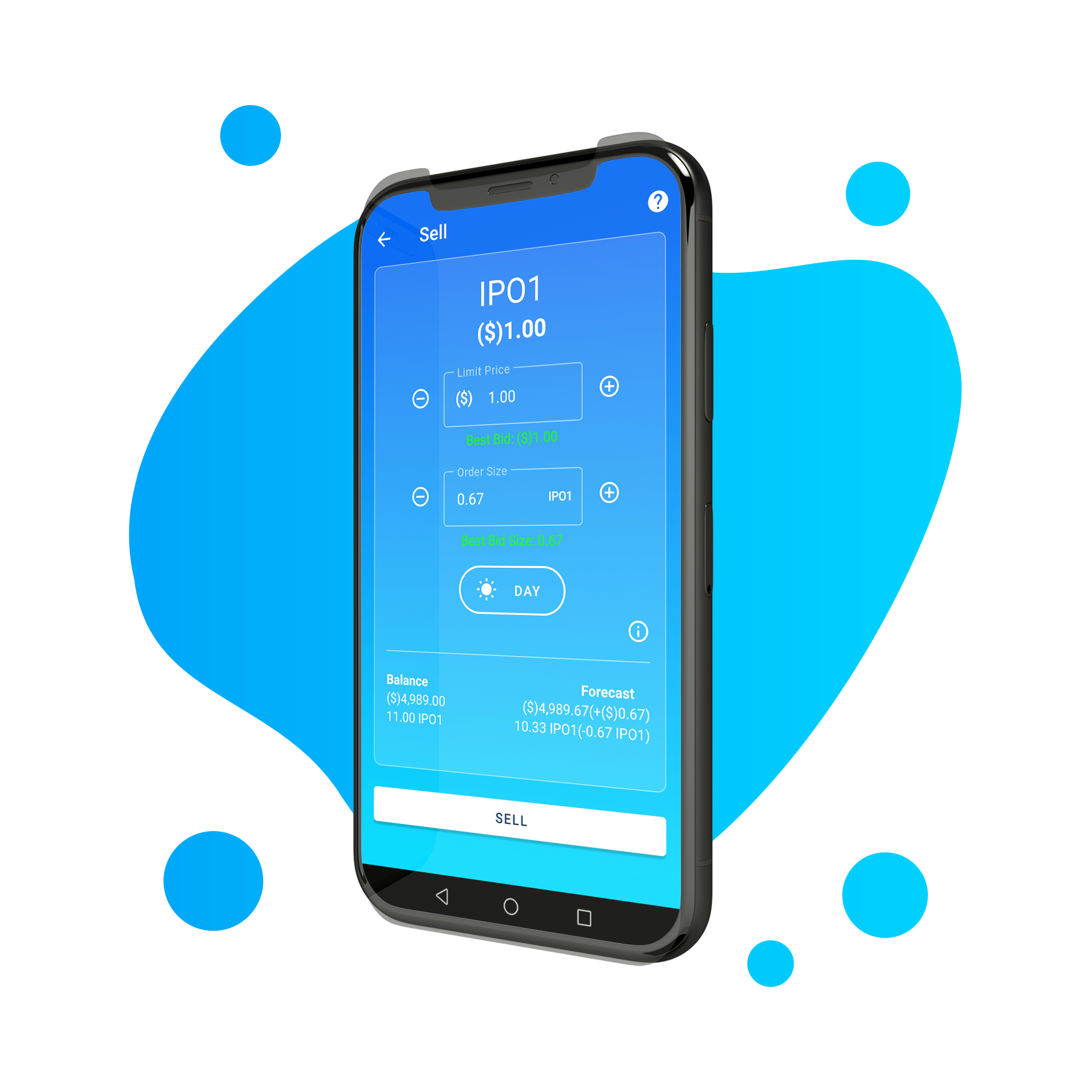

How do I sell securities?

- Navigate to the Market. You can also sell from the Portfolio section of the app.

- Tap on the security you’d like to sell

- Tap Sell; U.S. persons may not sell securities on Upstream.

- Set the Limit Price (i) (The Limit Price for an ask(sell) is the lowest share price you’re willing to sell your securities for). You’re guaranteed to sell for the price you set or more for your securities. Please note that the default Limit Price is automatically set to the best offer currently available on the market. The minimum price is $0.01.

- Select your Order Size (The Order Size represents how many shares you’d like to sell for the price you set per share) by typing in the number of shares you’d like to sell for the price you’ve selected or sliding the scale to your desired amount of shares you’d like to sell.

- You must have sufficient shares to complete the share sale as entered. Note, while your order is awaiting execution, the shares required for this transaction will not be available to you for other sell orders. You must have sufficient shares available to fulfil all of your open Sell orders.

- Hold and drag the Select Expiry button to select how long you want your selected offer to sell the securities to be available on the market.

- Tap the Sell button and verify your identity using biometrics and your order will be signed by the Upstream app and submitted to the blockchain orderbook.

- If your offer is filled or partially filled based on the parameters you’ve set, you’ll be notified via the app. Your new share balance will appear in the Portfolio section of the Upstream app and your available funds will be increased by the trade value (avg. share price * order size) minus 1%.

- You can see all your previous orders or active orders waiting to be filled by navigating to the Orders tab in the app.

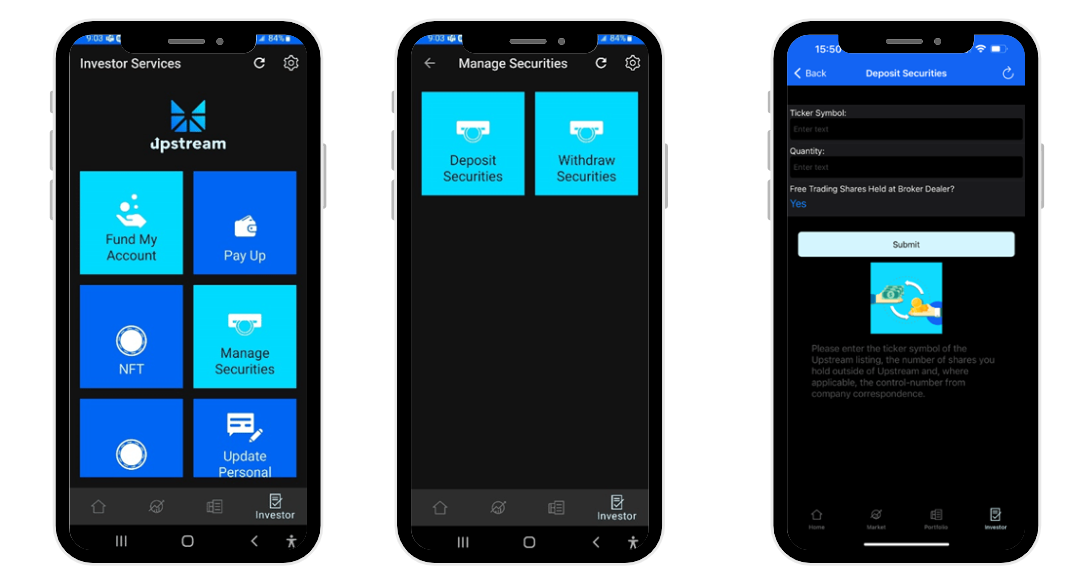

HOW DO I TRANSFER SHARES TO UPSTREAM?

Depositing your shares into Upstream is easy! Upstream can accept the shares that you hold in your current brokerage account, shares that are held at the transfer agent in entry, or your physical stock certificate. Here’s how to deposit your shares, step by step.

STEP 1. CREATE AN ACCOUNT ON UPSTREAM & VERIFY YOUR IDENTITY

- Download Upstream and tap Sign Up. This will create your blockchain profile and 'signing key'.

- Complete KYC. To complete KYC identity verification, tap the profile icon in the top right of the navigation, then tap KYC. Be sure to have a valid form of ID and banking details handy. It's important that bank account information matches your name exactly.

- Once your KYC is approved, you’re ready to move to the next step.

STEP 2. DEPOSIT YOUR SHARES WITH THE TRANSFER AGENT (NON-U.S. ONLY)

- If your shares are already held at the transfer agent, you may skip this step and move on to step 3. If your shares are held in a brokerage account, please complete the following:

-

Contact your broker’s customer service via email and let them know that you’d like to have your shares held as 'direct registration' in 'book entry' at the transfer agent. This must be done before shares can be deposited at Upstream.

- To find the issuer’s transfer agent to contact, please visit the issuer’s profile page on Upstream or visit the issuer’s investor relations page for transfer agent contact details.

- The brokerage firm will know what to do, and they will let you know how long it will take.

- Some brokerage firms may ask you to fill out their particular share transfer form. Contact us at servicedesk@upstream.exchange if you need assistance in completing a share transfer form from your brokerage firm.

- It is important that your name, address and social security number that your shares are registered under at the brokerage firm match the information that you provided when opening your account on Upstream. If your address at the brokerage firm is out of date, then you will need to update it with your brokerage firm BEFORE you transfer your shares to the transfer agent. Note, if the addresses do not match your address on Upstream, then your share deposit to Upstream will be delayed by the transfer agent.

- After receiving confirmation that your shares are with the transfer agent, you may request to deposit your shares on Upstream using the Upstream app.

STEP 3. REQUEST TO DEPOSIT SHARES USING THE UPSTREAM APP (NON-U.S. ONLY)

- Open Upstream, Tap Investor, Manage Securities, Deposit Securities. Next, select the Company’s Ticker Symbol and enter the Number of Shares you’re requesting to deposit. Tap Next.

- Confirm whether your shares are free trading or restricted and, optionally, enter your brokerage firm name and brokerage account number, and tap Next.

- Finally, tap Add E-Signature, sign your name on the screen using your finger, tap Done, and then tap Sign.

- Once the transfer is complete you will receive a push notification in the Upstream app and see the share deposit in your Upstream Portfolio. Please note, if shares are not yet listed, they will not be available for trading until listing day.

Please note that the value of each share deposit request on the Upstream app may not exceed $100,000. This value is determined by the closing price of the security on the previous trading day multiplied by the number of shares being deposited.

Once you make the share deposit request using the Upstream app, and the transfer agent has your shares in 'book entry', then most of the time the Upstream deposit process typically completes within 48 hours (Monday to Friday, excluding U.S. holidays).

STEP 4. YOU’RE READY FOR TRADING ON UPSTREAM (NON-U.S. ONLY)

Once the shares are in your account, you’re ready to trade on the next generation exchange! Enjoy real-time trading, a transparent orderbook, and other features enforced by blockchain technology. View your shares anytime, anywhere in your Upstream Portfolio. For more information on trading, visit Upstream’s support center.

Note, Upstream will consider requests for deposit and sale of Securities falling under the categories:

Shares trading on NASDAQ or the NYSE

Shares trading on the OTC Markets

Shares issued in private offerings exempt from registration under the Securities Act pursuant to Securities Act Rule 506(c) of Regulation D or Regulation S.

These offerings must comply with the Upstream view that securities must be registered or have a valid exemption from registration in connection with their original issuance pursuant to U.S. or European securities laws in order to qualify for secondary trading on Upstream. In addition, this applies to securities currently trading and held in DTC or Euroclear.

However, Upstream will not consider or accept for deposit any Securities:

- that were not issued pursuant to a registration or a valid exemption from registration;

- that were issued by a company or held by person that is a respondent to any regulatory authority actions, however the specific action may be reviewed for additional . information to allow deposit;

- that have any known “bad actors”, as such term is defined in US Rule in 262 of Regulation A or Rule 506(d) of Regulation D promulgated under the Securities Act; or

- that reference a company or customer name that has been changed or that does not match the name on the account and for which no valid reason is provided.

How do I move shares back to US markets?

It’s simple to move your shares back to the US Markets.

Step 1. Open Upstream, Tap Investor, Withdraw Securities. Enter Ticker Symbol and the Number of Shares you wish to withdraw, then tap Submit.

Step 2. The transfer agent will receive your shares immediately and will hold them in digital book entry in your name.

Step 3. The transfer agent will provide you via regular US mail a DRS Advice (Statement) that shows your shares are now held at the transfer agent in book entry. If you would like to move the shares back to your US brokerage account you will need to contact your broker, provide them with a copy of your DRS Advice and have them request that the transfer agent send back your shares. They will provide you with appropriate forms to complete.

What are the different order expiry options?

+Immediate or cancel (IOC)

Will execute all of your order immediately, or if the entire order cannot be filled, it fills part of your order and cancels any unfilled portion of the order.

+1 hour

If the order doesn’t fill in one hour it will expire and be cancelled.

+Day

If the order doesn’t get filled by market-close today, then the order will expire and be cancelled.

+A custom date

If the order doesn’t get filled by market-close on the set date it will expire and be cancelled.

+Fill or Kill (FOK)

The order will only execute it the entire order size can be purchased. If it can’t, then the order will be withdrawn.

How do I manage my security Portfolio?

View all your shares and currency account balance from the Portfolio tab of the Upstream app.

How do I sell securities from my Portfolio screen?

Navigate to your portfolio and click on any of your positions to view more details.

You have the options to

|

+Sell |

Tap Sell to sell your shares in the same way as described above in “How do I sell securities?” |

|

+Stop Loss |

Select the drop-down menu at the top right and select “Stop Loss”. This creates a secret, off orderbook, order to offer to sell your securities if the share price falls to a specified Trigger price, the “stop-loss point”, with the Limit price being the lowest price you’re willing to accept below the trigger. The Limit price must be lower than the trigger and, depending on market conditions, no shares may be sold if the trigger is reached and there are insufficient buys to fulfil your order. Stop Loss orders are designed to limit an investor’s loss on a position when the market falls suddenly or perhaps when the investor isn’t using the app (e.g., while sleeping, or traveling etc.). |

|

+Take Profit |

Select the drop-down menu at the top right and select “Take Profit”. This creates a secret, off orderbook, order to offer to sell your securities if the share price rises to a specified Trigger price, the “take-profit point”, with the Limit price being the lowest price you’re willing to accept below the trigger. The Limit price must be lower than the trigger and, depending on market conditions, no shares may be sold if the trigger is reached and there are insufficient buys to fulfil your order. Take Profit orders are designed to lock-in an investor’s profit on a position when the market rises suddenly or perhaps when the investor isn’t using the app (e.g., while sleeping, or traveling etc.). Investors may risk not being able to sell the securities for an even higher price if the trend continues upward after reaching the initial trigger “take-profit point.” |

|

+Trailing Take Profit |

Select the drop-down menu at the top right and select “Take Profit”. Similar to “take-profit” but designed to create an order to remain open and continue to profit as long as the price is moving in the investor’s favor. The order closes the trade if the price starts falling by the specified Trailing Percentage or dollar amount. |

How do I add a security to my Watchlist?

Tap Market

Tap on the security you’d like to watch

Tap the star to the right of the ticker symbol

Navigate back to the Market and tap Watchlist to view all favorited securities

How do I cancel an active securities order?

To cancel an order:

Login to the app

Tap Orders

Tap on the order you’d like to cancel

Select Cancel and sign the transaction using your Signing Key

How can I see the blockchain details for my orders?

To view the technical details of your Upstream orders on the Upstream layer-2 rollup blockchain, you need to go to the Orders tab, tap the “All” sub-tab, select the order you wish to view and tap the link below “Order ID”, or where applicable, tap the link(s) below “Trade Reports”. This will open a webpage in the Upstream block explorer, Dora. Dora shows the Ethereum blockchain transaction hash, the mining status, the block height, timestamp, (anonymous) public-key addresses of the trading parties, trade value, network gas consumption, input data and other details. Note, Upstream operates on a public blockchain, so all order-data is available to the general public, but does not disclose or otherwise indicate any identifying details about your account. It only discloses your Public key, as is the norm for public, anonymous blockchains.

What are candlestick charts?

Candlestick charts are an efficient way to look at a lot of information about a stock's price at once. It shows how much the price moves up or down in a certain time period to help investors better understand price movement.

Does Upstream offer margin trading?

Upstream currently does not offer margin trading.

Does Upstream allow naked short selling?

Upstream does not permit the naked short selling of securities. Naked short selling, or naked shorting, is the practice of short-selling a security without first borrowing the shares from another party.

Does Upstream solicit trades?

Upstream does not solicit trades or advise Upstream users of the suitability of any trade, IPO, or other offering. Investors who trade through the Upstream platform make their own trading and investment decisions. Upstream does not endorse or recommend any securities bought or sold on the Upstream exchange. Upstream does not offer investment advice or recommendations of any kind. All services offered by Upstream are intended for self-directed clients who make their own investment decisions, without aid or assistance from Upstream. Company listings on Upstream are only suitable for investors who are familiar with and willing to accept the high risk associated with speculative investments, often in early and development stage companies. The securities are intended for investors who do not have a need for a liquid investment. There can be no assurance the valuation of any particular company’s securities is accurate or in agreement with the market or industry comparative valuations. Companies listed tend to be in an earlier stage of development and have not yet been fully tested in the public marketplace. Investing in those companies requires high risk tolerance, low liquidity concerns and long-term commitments. Investors must be able to afford to lose their entire investment. U.S. persons may not trade securities on Upstream.

For additional information on suitability, please review the Suitability FAQ section.

What are the fees associated with trading?

For traded securities there is a 1% trade fee charged should you buy or sell shares in the open market.

What is a dividend?

Dividends may be payments made by companies to its shareholders from the profits of their business. Upstream manages the distribution of U.S. Dollars dividends on behalf of Upstream issuers.

What is an ex-dividend and record date?

The ex‐dividend date, or record date, is the cut-off date established by a company in order to determine which shareholders are eligible to receive a dividend or distribution

What are the risks of investing?

Company listings on Upstream apps and/or websites are only suitable for investors who are familiar with and willing to accept the high risk associated with such investments and early-stage growth companies. U.S. persons may not trade securities on Upstream. Companies seeking crowdfunding or private placement investments tend to be in earlier stages of development and have not yet been fully tested in the public marketplace. Investing in these securities requires high risk tolerance, low liquidity concerns, and long-term commitments. Investors must be able to afford to lose their entire investment. In addition, there can be no assurance the valuation is accurate or in agreement with the market or industry valuations.

For high risk securities there may be no liquidity, limited liquidity and redemption fees may apply if redeemed before maturity as outlined in each offering prospectus.

Upstream encourages its Customers to invest carefully and to study information on companies available at a variety of websites.

For additional information on suitability, please review the Suitability FAQ section.

GETTING LISTED ON UPSTREAM

How do I list my company on Upstream?

Congrats on wanting to include liquidity as part of your growth strategy! Visit our Get Listed page to learn more and begin the application process. We make the process as seamless as possible for you to list on the revolutionary exchange and trading app. We also make the process simple for investors to participate in your offering. For additional questions not answered on the Get Listed page, please contact the team at servicedesk@upstream.exchange.

How do I receive an application to list my company on Upstream?

Please navigate to the Get Listed page and fill out your email, name, and desired transaction. You will be sent the appropriate materials and listing application.

What are the benefits of listing my company on Upstream?

As you know, liquidity is tough today. International retail investors do not have the ability to directly purchase U.S., Canadian, and other listed securities without going through a cumbersome process. This may be limiting issuers’ ability to raise capital, increase liquidity and access new investors. The concept of directly accessing dual listed securities using just an app did not exist…until Upstream.

Traders simply download, complete light-touch KYC, and fund their account using U.S. dollars, credit card, debit card, PayPal, or USDC digital currency all from within the secure trading app. Upstream is designed to unlock liquidity, enhance price discovery, and truly globalize the opportunity to invest in exciting growth opportunities like yours.

Additionally, listing on Upstream comes with over $100,000 of additional IR value for your company from Upstream.

Why should I make secondary trading a part of my growth strategy?

- Direct Access to a Regulated Market: Upstream gives investors direct access to the market through a user-friendly trading app. Upstream, a MERJ Exchange market, is an affiliate of the World Federation of Exchanges (WFE), recognized by HM Revenue and Customs UK as a ‘Recognized Stock Exchange’, a full member of the Association of National Numbering Agencies (ANNA) and a Qualifying Foreign Exchange for OTC Markets in the U.S.

- Address Common Challenges: Upstream was built with the specific purpose of addressing the common challenges issuers face on the OTC market. Our dedicated team of Wall Street pioneers and software engineers have worked diligently to overcome these hurdles.

- Cutting-Edge Features: Upstream offers a range of cutting-edge features to enhance issuers’ experience including seamless transfer agent integration, a prohibition on naked short selling, and high-tech, user-friendly trading tools powered by smart-contract technology.

- Shareholder Loyalty and Engagement: We have designed a unique program to reward your shareholders for their loyalty and support. Through our digital coupon program, shareholders can receive coupons that can be redeemed for your company's products, services, experiences, or events. This program enhances fan engagement, drives revenue, and encourages active trading among shareholders.

What Types of Assets are Traded on Upstream?

- Deposit, buy and sell securities and Collectibles from U.S. and international companies on one global trading app.

-

Types:

- Dual listed securities

- IPOs

- Athlete/celebrity ventures

- Crowdfunded companies

- Digital collectibles

What's included in Upstream's marketing package for listing?

-

Issuers receive $100k IR value included in our marketing package to help bring visibility to their listing.

Media Community:

- IBN

- Mission Matters

- New to the Street

- ADVFN

- The Average Joe

- Spotlight Growth

WHAT IS A DIGITAL COUPON?

Upstream issuers’ digital coupons are awarded to all shareholders as a redeemable non-fungible token (Collectible), one per shareholder regardless of the number of shares owned as of the record date. The digital coupons are not securities and are issued as ERC-721 tokens, an Ethereum blockchain standard for representing ownership of Collectibles where each token has a unique identifier.

Our digital coupon strategy for Upstream issuers leverages our redeemable Collectible technology to drive shareholder engagement and additional issuer revenue potential. It allows shareholders to get firsthand experience with issuers’ products and opens the door for new customers as shareholders may decide to sell the digital coupon for US dollars on Upstream’s regulated market to non-shareholders.

Digital coupon Collectibles have no royalties, equity ownership, or dividends. Collectibles are for utility, collection, redemption or display purposes only.

HOW DO I CLAIM A DIGITAL COUPON?

Shareholders as of the announced record date can claim their digital coupon with the following steps:

- Download Upstream from your preferred app store at https://upstream.exchange

- Tap sign-up and complete a simple KYC identity verification. KYC reviews typically within 48 hours Monday-Friday.

- Once KYC is approved, tap Investor, Collectibles, claim, enter the claim code, which is announced by the issuer, then Claim.

Once verified, shareholders will find their digital coupon in their Upstream portfolio, typically within 48 hours, and may then sell the digital coupon on Upstream or redeem the digital coupon. If shares are held at a brokerage, you will receive a request for an account statement via email to verify that you’re a shareholder as of the set record date.

HOW DO I REDEEM A DIGITAL COUPON?

- Before you can redeem a digital coupon, you must have successfully claimed or purchased it. You can check that you've successfully received your digital coupon by opening Upstream, tapping Portfolio and finding your digital coupon there. Now you’re ready to redeem the digital coupon for your reward!

- Open Upstream, tap Investor, Collectible, Redeem, and select the digital coupon (Collectible) ticker symbol for the Collectible you are redeeming.

- Tap ‘Redeem.’

- Upon successful redemption, the holder will be shown a unique redemption code and the digital coupon will be removed from the Upstream portfolio.

Supply the unique redemption code to the Issuer to fulfill the utility. Find your redemption code any time from the Message Center by opening the Upstream app and tapping the mail icon in the top left corner.

Dual Listings:How do I dual list on Upstream?

We’re inviting issuers listed on major stock exchanges to list on Upstream and access a global investor base. Get started on our Get Listed page or email us at hello@upstream.exchange with other inquiries.

What does Upstream provide companies wishing to dual list?

We’re inviting issuers listed on major stock exchanges to list and provide an international investor base the ability to trade their shares using an app from anywhere in the world.

- Dual listing your company on Upstream is simple and only takes about 30 days.

- Experience a potential increase in local share-trading volume through Upstream's global exposure.

- Access new investor capital locally and globally.

- Upstream is a part of MERJ. MERJ is a fully regulated and licensed exchange affiliated with the World Federation of Exchanges, recognized by HM Revenue and Customs UK, and a member of various esteemed organizations.

IPOS:

What is an IPO?

An Initial Public Offering (IPO) is the first sale of stock by a company to the public. If an IPO is successful, the shares of the company will usually begin publicly trading on a stock exchange like Upstream/MERJ, the London Stock Exchange, Toronto Stock Exchange etc. U.S. persons may not invest in IPOs on Upstream.

What makes Upstream IPOs unique?

Typically in an IPO, the general public has to wait for the stock to begin trading on a national exchange in order to purchase shares. With other popular trading apps, you’re able to place a “Pre-IPO” order but you’re not participating in the IPO, you’re just entering your orders for when trading begins.

On Upstream, investors have the ability to order shares before the IPO closes and before trading begins.

Why did I not get my full indication?

Here’s where Upstream operates a little differently. Our goal is to provide as many people as possible with at least some IPO stock at the same price and time as Wall Street. This means every investor who wishes to participate before an IPO closes will be able to. For IPOs in high demand, you may not receive all the shares you ordered. If this happens, at the time the IPO closes, then you will be allocated shares on a pro-rata basis and all of your unspent funds will be unblocked. IPO allocations are not guaranteed and our goal is to level the playing field and distribute shares fairly across all interested public participants.

When can I trade following the IPO?

Upstream IPOs securities are registered, unrestricted securities free to trade on the Upstream app the next trading day following the IPO close. U.S. persons may not trade securities on Upstream.

How long does it take for trades to settle on Upstream?

Trades on the Upstream secondary market instantly settle. For IPOs, trades settle immediately upon IPO close. If you are the seller, then you may withdraw funds as soon as your trade is executed. Note, naked short selling of securities is not permitted on Upstream. Similarly, a buyer must have sufficient funds in their account to place a buy order. This ensures that the seller can be paid, in full, immediately upon trade execution.

SPINOFF SHARE DISTRIBUTIONS

What is a spinoff share distribution?

A spinoff is a new company that's created when a parent company distributes shares in a subsidiary or business division to the parent company shareholders. All parent company shareholders as of a set record date (i.e., shares purchased and held 2 days or more prior to the record date) will be entitled to receive an equal proportion of shares in the spinoff company.

How do I participate in a spinoff share distribution?

U.S. persons may claim spinoff securities on Upstream, however, U.S. persons may not deposit their claimed shares for secondary trading on Upstream. Please visit the Issuer’s investor page for more information. U.S. persons may not trade securities on Upstream.

Non-U.S. shareholders of the set record date can download Upstream and complete KYC identity verification ahead of the distribution date, please proceed to claim your shares on the Upstream app. After receiving your brokerage statements confirming your shareholding as of the set record date you may use the Upstream app to request your share distribution and verify your shareholding.

How do I request my spinoff share distribution?

U.S. persons may not deposit, buy, sell, withdraw or claim spinoff securities on Upstream. Please visit the Issuer’s investor page for more information.

Once your KYC identification has been approved on Upstream, you’ll be able to request your share entitlement on the app.

- On the Upstream app, tap Investor, Manage Securities, then tap Spinoff Securities.

- Select the spinoff ticker symbol from the menu dropdown, select the parent company ticker symbol, and enter the number of shares owned in the parent company as of the record date. Note: Share entitlement will be the number of shares of the parent company you held as of the record date divided by a spinoff ratio, which will be disclosed by the company after the record date. It is extremely important that you enter the correct number of shares you owned in the parent company as of the record date. Any variation may result in delayed share delivery and additional information requests.

- Tap Claim.

- Upstream will send you an email to verify your shareholding. You’ll be asked to send a copy of your brokerage statement(s) via email showing your parent company shareholding as of the record date (i.e., parent company shares purchased and held 2 days or more prior to the record date).

- Once your parent company shareholding has been verified by Upstream and after the distribution date, your spinoff company share entitlement will be automatically deposited into your Upstream Portfolio. You’ll receive a push notification in the Upstream app announcing their delivery. Shares may take up to 5 business days to post to your Upstream portfolio after your initial claim.

Please note that spinoff share allocations to Upstream accounts will not begin until the distribution date.

When can I trade my shares if they’re restricted?

If shareholders receive restricted shares, they may be eligible for removal of restrictions and traded on Upstream six months after the share distribution date, if certain requirements are met.

Visit the Get Listed Page to view more of the benefits or email us at hello@upstream.exchange with other inquiries.

SHORT SELLING

What is Short Selling?

Short selling is borrowing securities and selling them in anticipation of a price decline. The availability of short selling leads to a well-functioning, robust, and efficient securities trading marketplace. A short seller either believes that (a) share prices are overvalued and will fall or (b) uses a short position to hedge other parts of a securities portfolio, such as a long position in stock index futures or an options position.

Short selling contributes to better price discovery which enhances market efficiency. It improves market liquidity by leveraging Upstream's automated Market Pools, and it enables investors to manage investment portfolios more efficiently.

What are the key features of Upstream's Short Selling service?